If you’re looking to simplify your tax preparation process, using a mileage log for taxes printable can be a game-changer. Keeping track of your mileage is crucial for claiming deductions and maximizing your tax savings.

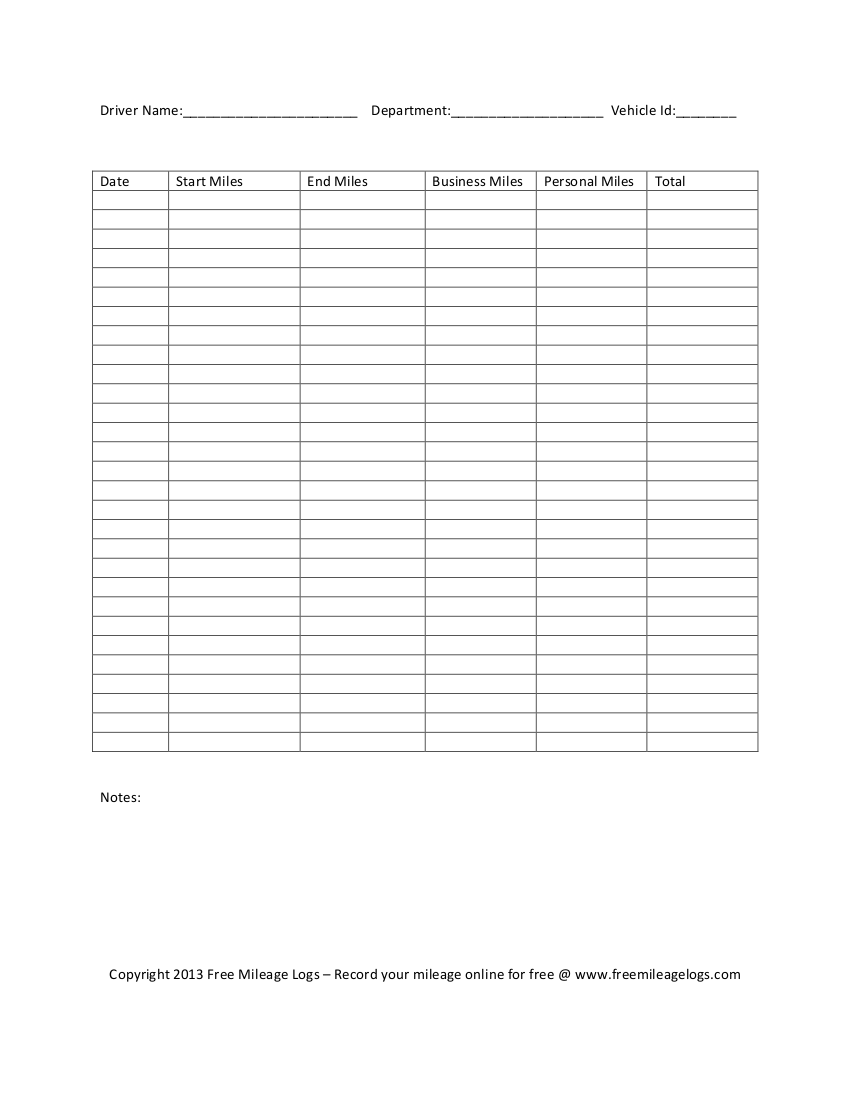

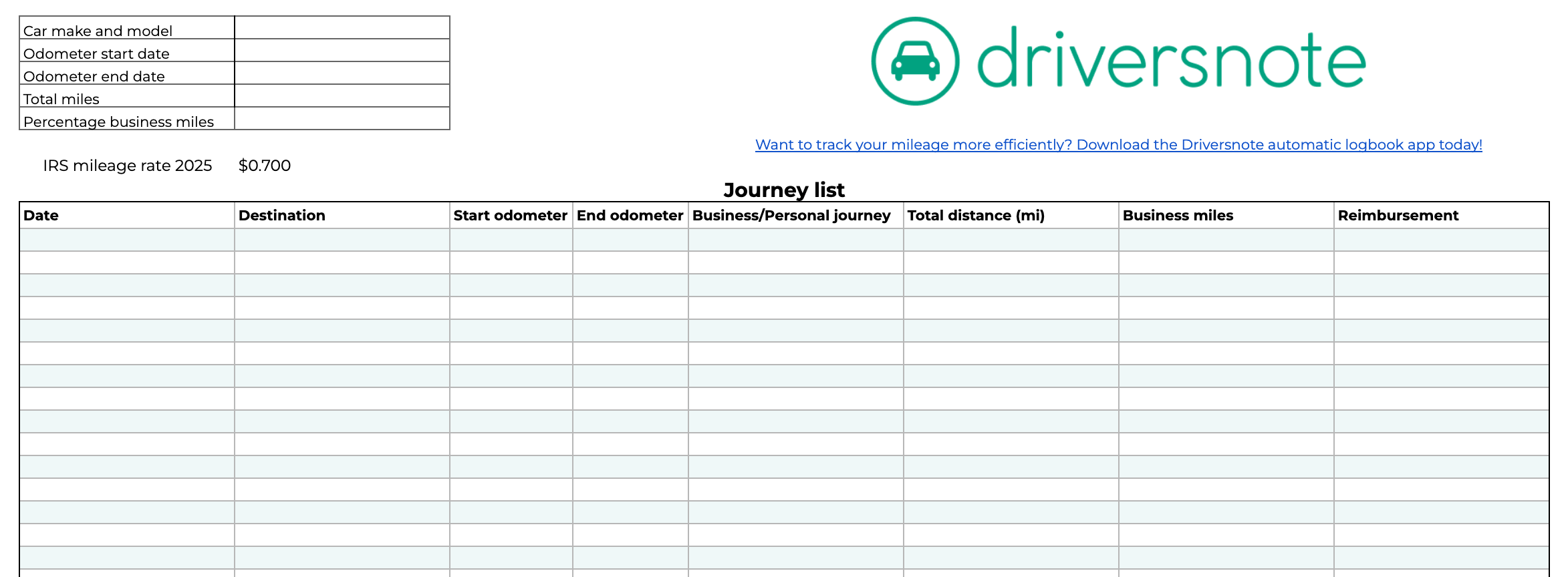

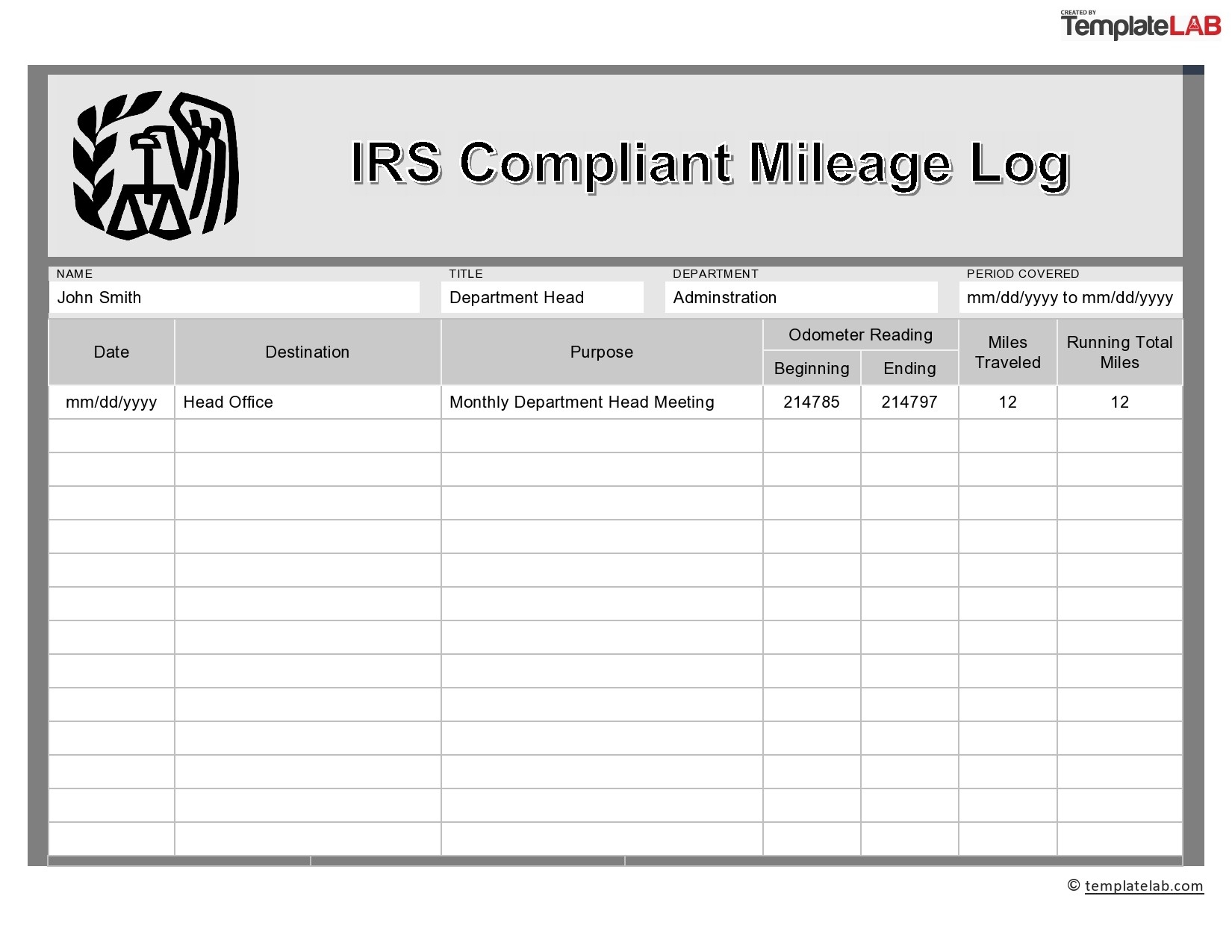

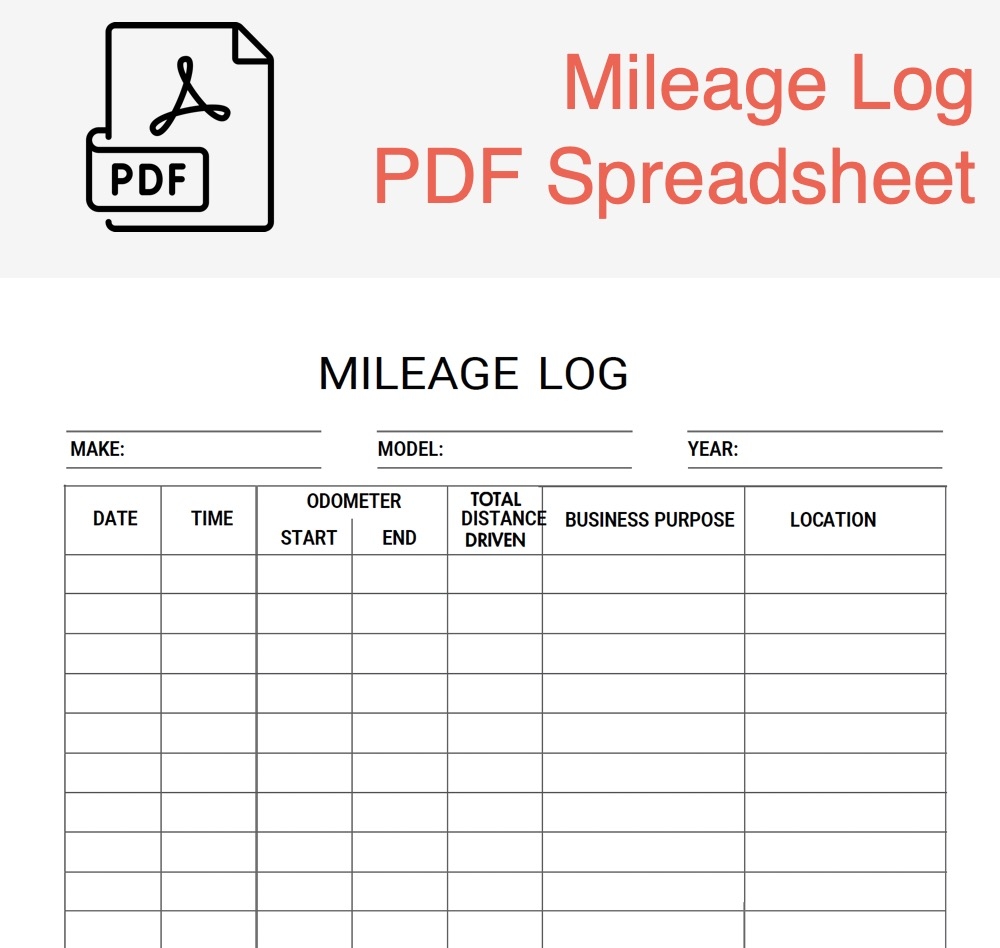

By using a mileage log, you can easily record all of your business-related driving expenses, including the date, starting and ending locations, purpose of the trip, and total miles driven. This information is essential for calculating your deductible mileage and reducing your taxable income.

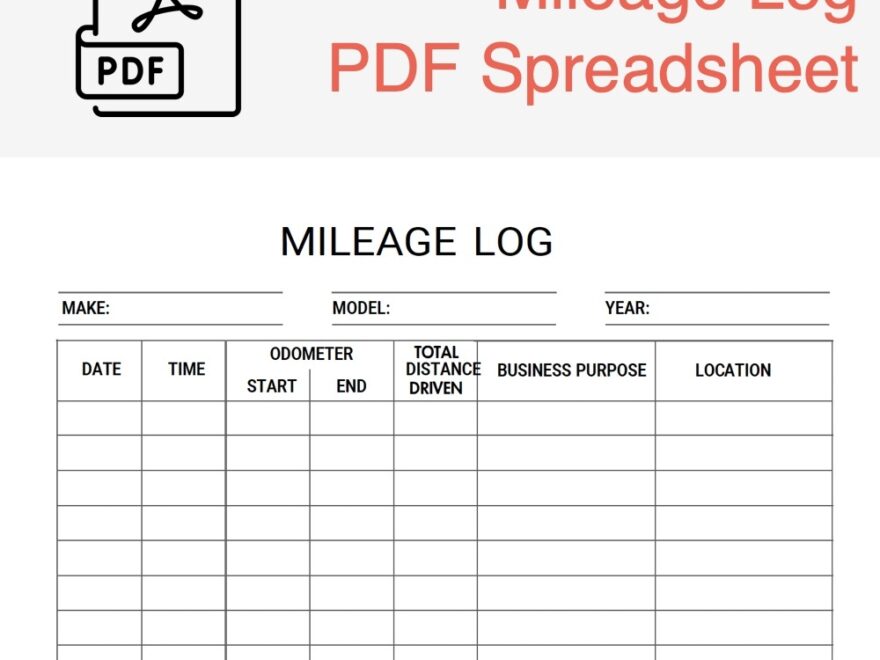

Mileage Log For Taxes Printable

Mileage Log For Taxes Printable

Having a printable mileage log template makes it easy to stay organized and ensure you don’t miss any deductions. You can find free mileage log templates online that you can download and print out for your convenience.

Simply fill in the required information each time you drive for business purposes, and keep all your receipts and records in one place. This will not only save you time but also help you avoid any potential issues with the IRS during tax season.

Remember to update your mileage log regularly and keep it accurate and up to date. The more detailed and precise your records are, the better prepared you’ll be when it’s time to file your taxes. It’s a simple yet effective way to save money and minimize your tax liability.

Using a mileage log for taxes printable is a smart and efficient way to track your business-related mileage and ensure you’re taking advantage of all available deductions. With tax season around the corner, now is the perfect time to start keeping detailed records and maximizing your tax savings.

Download Free Printable IRS Mileage Tracking Templates GOFAR

Free Printable Mileage Logs

Free Mileage Log Template IRS Compliant Excel PDF

20 Printable Mileage Log Templates Free TemplateLab

IRS Printable Mileage Log Templates Free Excel PDF Google Sheets ExpressMileage